Bank of Baroda in Kampala Uganda. PHOTO | NMG

Shareholders of Uganda’s Bank of Baroda are this week expected to vote on a rights offer meant to raise the lender’s capital base and be on the right side of financial regulations imposed three months ago.

Anne Tumwesigye Mbonye, Bank of Baroda company secretary, in a notice to shareholders, said the lender has opted to float 15 million bonus shares in rights offer to raise the Ush150 million ($39,900) at a ratio of 1:5 ratio priced at $0.0026 each.

The proposed cash infusion is subject to shareholders’ approval during the annual general meeting on March 23.

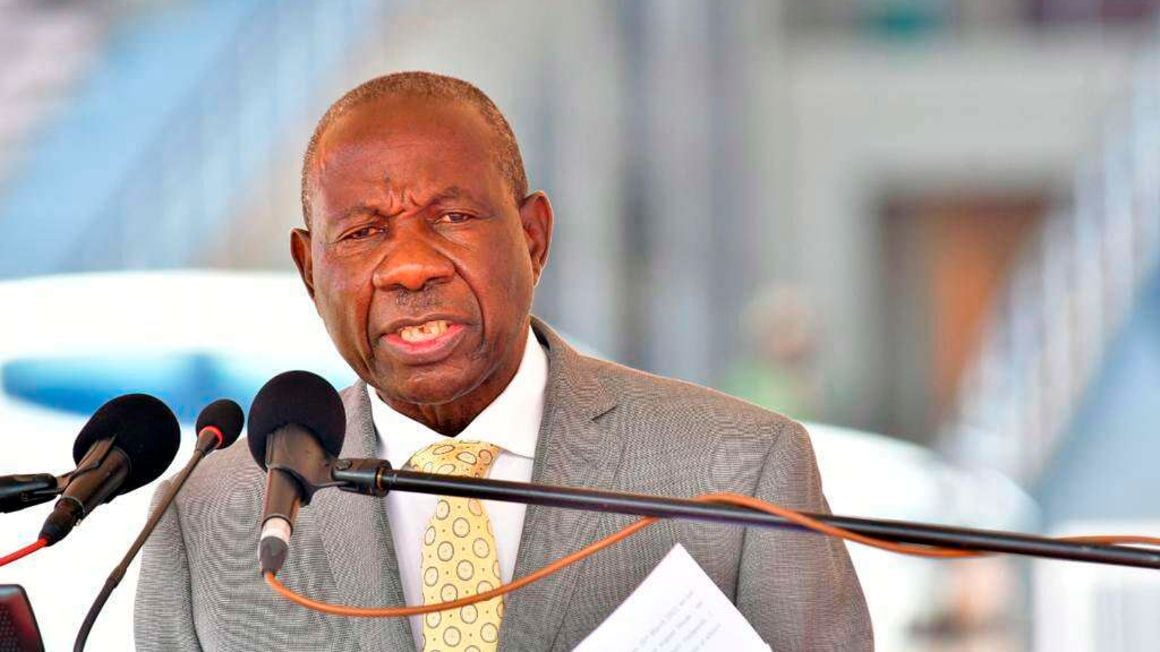

The move came just three months after Uganda’s Finance Minister Matia Kasaija signed a statutory instrument increasing minimum capital for banks by 500 per cent, from $6.67 million to over $40 million.

Uganda's Finance Minister Matia Kasaija. PHOTO | COURTESY

The idea, according to the Bank of Uganda (BoU), is to prevent commercial banks from falling off the cliff when economic shocks hit their clients.

According to the new rules, regulated micro financiers’ paid-up capital also increased to $6.6 million from $267,636.

The new capital requirement has thrown a spanner in Uganda’s banking sector works. The industry has reported one exit — Afriland First Bank last year after 16 months in the market.

Top Finance Bank was bought by Djibouti-based Salaam African Bank after the original owners failed to infuse capital. Orient Bank was acquired by I&M Group for the same reason.

Regional convergence

Uganda last revised the paid-up capital for commercial banks in 2010 while that for credit institutions and deposit-taking institutions was last revised in 2004 and 2003 respectively, according to the BoU.

“The increase in paid-up capital is long overdue and is intended to match the dynamism in the economy, incentivize shareholder commitment, and enable institutions to withstand shocks and to converge with regional peers among whom Uganda effectively has the lowest paid-up capital,” Tumubweine Twinemanzi, the director in charge of supervision at BoU said.

The new rules follow trends in the region where some banks collapsed after reporting bad loans.

Read: Africa’s risk of debt piles as countries fight inflation

In 2018, Rwanda raised its paid-up capital requirement to Rwf20 billion from five billion francs. Kenya has also targeted both commercial banks and deposit-taking cooperative societies.

An earlier move, in 2016, however by Kenya’s Treasury to increase the minimum capital requirement for commercial banks from KSh1 billion ($7.69 million) to KSh5 billion ($38.43 million) was rejected with lawmakers arguing it would kill competition and make it difficult for small banks to grow. By KABONA ESIARA, The East African